For crypto entrepreneurs entering the European market, regulation is the foundation of sustainable growth. With the EU’s Markets in Crypto-Assets (MiCA) framework now in force, choosing the proper licensing jurisdiction can determine how quickly and smoothly a business scales across Europe.

Among EU member states, Poland has emerged as one of the most practical and cost-effective destinations for securing a Crypto-Asset Service Provider (CASP) authorization. A Polish license offers regulatory clarity under MiCA while enabling passporting across all 27 EU countries. With the proper advisory support, compliance becomes a strategic advantage rather than an operational burden.

That is where Fintech Harbor Consulting Ltd. plays a key role, guiding crypto ventures through licensing and long-term compliance in Poland.

Why Poland Is a Strategic Choice for Crypto Businesses

Poland has a well-established history in the digital asset sector, having supported major platforms such as BitBay (now Zonda) and Bitstamp. Today, its appeal lies not only in experience but in scalability. The Polish crypto market is projected to grow steadily, with revenues expected to exceed €430 million by 2027 and user adoption continuing to rise.

More importantly, Poland offers full MiCA passporting rights. Once licensed, CASPs can provide services across the EU, often within 15 days, without seeking separate national approvals. This significantly reduces regulatory friction and accelerates market entry.

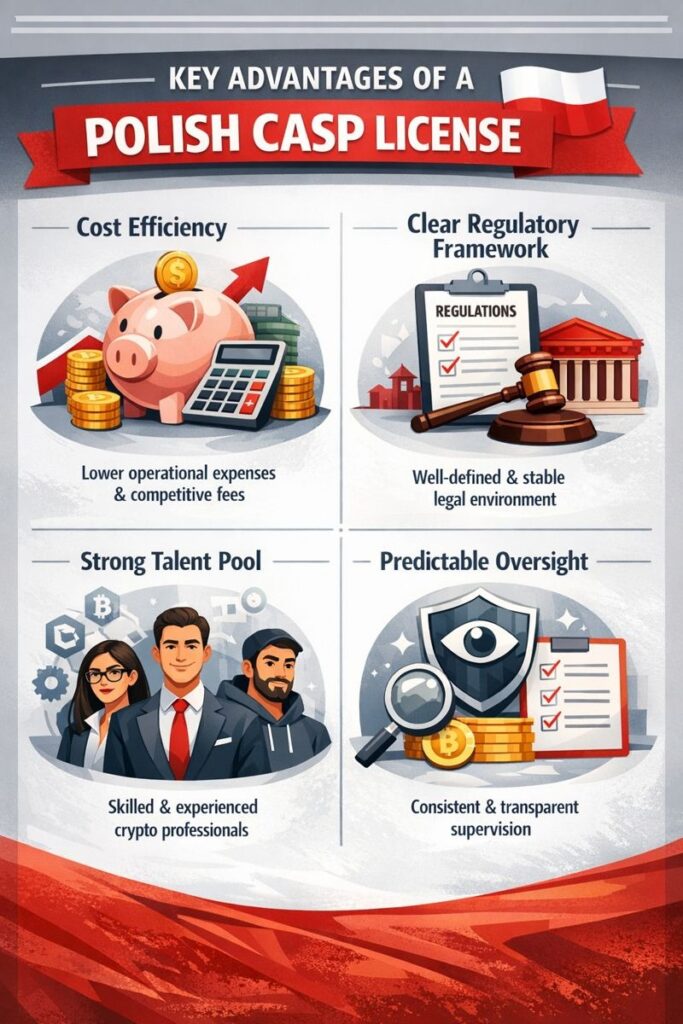

Key advantages of a Polish CASP license include:

- Cost efficiency: Corporate income tax is 19%, or 9% for qualifying small or new companies. Many crypto-related transactions are exempt from VAT under EU court rulings.

- Clear regulatory framework: MiCA defines requirements for AML/KYC, governance, and consumer protection, improving credibility with banks and partners.

- Strong talent pool: Poland offers access to skilled technical and compliance professionals at competitive costs.

- Predictable oversight: A stable regulatory environment allows founders to plan with confidence.

For many crypto operators, Poland offers a rare balance of compliance certainty and commercial flexibility.

How to Obtain a Polish Crypto Exchange License

While MiCA harmonizes crypto regulation across the EU, licensing requirements still depend on the specific services offered. In Poland, applicants typically need to meet the following criteria:

- Share capital: Between €50,000 and €150,000, depending on activities such as custody or trading.

- Local presence: A registered Polish office and at least one EU-resident director.

- EU bank account: A corporate account with a recognized EU financial institution.

- Internal policies: A business plan, AML/CFT procedures, governance framework, risk assessments, and complaint-handling processes.

- Fit-and-proper checks: Background documentation for directors and shareholders.

The licensing process usually takes around four months and follows these steps:

- Incorporate a Polish legal entity, commonly a Sp. z o.o.

- Secure office space and open an EU corporate bank account.

- Prepare MiCA-compliant internal documentation.

- Apply to the Polish Financial Supervision Authority (KNF).

- Address regulatory questions and obtain approval.

Businesses operating under Poland’s previous VASP regime may continue activities until mid-2026, but must submit CASP applications before the transition deadline. New ventures must apply directly under MiCA.

Fintech Harbor Consulting: Your Licensing Partner in Poland

Navigating MiCA requirements independently can be time-consuming and risky. Fintech Harbor Consulting Ltd., with offices in London and Warsaw, provides end-to-end support for crypto businesses seeking authorization in Poland and expansion across the EU.

Their services cover licensing strategy, documentation, regulator communication, and ongoing compliance.

Licensing packages include:

- Existing companies: From €25,000, covering consultation, application preparation, and first-year compliance support.

- New company setups: Approximately €33,000, including company formation, bank account assistance, and a complete MiCA policy framework.

All costs are disclosed upfront, including capital requirements.

With MiCA penalties reaching up to €5 million, working with experienced advisors is a critical risk-management decision. For entrepreneurs pursuing a Poland crypto exchange license, Fintech Harbor offers a proven, efficient path to approval.

Start Your EU Crypto Expansion Today

MiCA has reshaped Europe’s crypto landscape, rewarding businesses that prioritize compliance from day one. A Polish CASP license provides access to the entire EU market, regulatory predictability, and long-term scalability.

Whether you are launching a crypto exchange, wallet, or trading platform, Fintech Harbor Consulting helps you move forward with confidence.

More Stories

Customer Service Explained: Processes, Channels, and Strategic Impact

How to End a Session Without the “One More Bet” Spiral

Understanding the Digital Systems That Power Online Creativity